To Protect The Prime Minister’s Credibility For Financial Soundness And Accountability, Bank Negara Must Take Action Against Those Responsible For Maybank’s Reckless Acquisitions Of PT Bank International Indonesia(BII) And Pakistan’s MCB Bank That Caused Impairment Losses Of RM 2 Billion.

In order to protect Prime Minister Datuk Seri Najib Tun Razak’s credibility for financial soundness and accountability, Bank Negara must take action against those responsible for Maybank’s reckless acquisitions of BII and MCB Bank that caused impairment losses of RM 1.97 billion. Maybank’s 30 June 2009 fiscal year net profit plunged 76% to RM 692 million as a result of impairment losses of RM 1.62 billion for acquiring BII(in March 2008) and RM 353 million for acquiring MCB Bank.

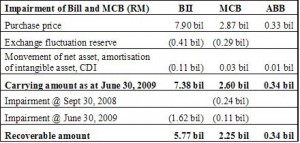

Source : Maybank 4th Quarter Analyst Briefing 2009

Even though Maybank was advised not to proceed with the acquisition, Maybank had stubbornly and irresponsibly pressed on to spend an incredible RM 10.8 billion to acquire banks in Indonesia, Pakistan and Vietnam, months before the global financial crisis erupted last year. Now Maybank conceded that it has lost RM 2 billion in these investments in over a year.

However if we consider other losses due to exchange rate fluctuation and amortisation Maybank lost not just RM 2 billion but RM 2.73 billion. Looking at the graph above, Maybank bought BII for RM 7.9 billion which is worth only RM 5.77 billion now and paid RM 2.87 billion for MCB Bank which is worth only RM 2.25 billion now. In other words Maybank incurred RM 2.13 billion loss for BII and RM 620 million loss for MCB Bank for a total loss of RM 2.73 billion.

Public interest demands that action be taken against those who squandered Maybank’s funds in these doubtful investments. We do not know how much of the RM 10.8 billion investments will be left and this large sum, if distributed would allow each and every 27 million Malaysians to get RM 400. Why did Maybank proceed with the purchase despite every advice not to do so? As Maybank is owned by the government, the public has every right to demand full public accountability and action against those responsible for such reckless management decisions that has caused losses of RM 2.73 billion.

Otherwise there will be a loss of public and investor confidence that the government is committed towards fair, clean and orderly capital markets. In the light of the world economic recession brought about by the global financial crisis, markets must be subjected to stronger oversight. Governance arrangements and risk management standards at the financial level must be strengthened. Regulatory objectives of fair and orderly markets, transparency, financial soundness, investor protection and accountability must be met.

A good starting point for delivery is to take action against those responsible for Maybank’s huge RM 2 billion losses. Bank Negara must send an unmistakable message that Malaysia is a worthy destination for global capital finance that has a level playing field which plays by the rules of law, enforced impartially and committed towards competency, accountability and transparency.