The topic of discussion today is ‘The Rise of Asia and China’s Role’. I can conceive of two fruitful approaches in which we can discuss this very general topic in greater depth and detail.

The first approach is to discuss China’s role in ensuring continued economic growth for itself as well as for the region as a whole and perhaps touch briefly on how Asia’s economic strength can be leveraged into other areas of influence in the larger geo-political environment.

The second approach is to broach this topic from the perspective of the role of other countries in Asia vis-à-vis their China and how these countries can be a positive influence in aligning the interest of China with the region so that Asia can continue its rapid climb, economically and politically. One may look at both approaches at two sides of the same coin.

Introducing Asia’s growth

Asia today still largely made up of developing countries. But these developing countries have been and will continue to grow at much faster rates than other parts of the world. During the economic crisis, GDP growth for Developing Asia in 2009 was 6.6%, while World GDP (or GWP) experienced contraction of -0.6%. Developing Asia is expected to continue growth trend, expanding at 8.5-8.7% in GDP terms for the next 5 years.[1]

China’s Growth within the context of a growing Asia

And China is one of the few key economic drivers within Developing Asia. From the start of the millennium, China’s economic growth has averaged a robust 8.0%, reaching a peak of 11.4% in 2007.[2] Latest statistics show that the Chinese economy expanded 9.6% after the 3rd quarter of 2010[3], and is expected to reach a rate of 10.0% growth by the end of this year[4]. Furthermore, China’s growth is expected continue at an average of 9.4-9.8% for the next five years.[5]

Presently, China is already the second largest economy in the world. As early as 2001, China overtook Japan’s economy in Purchasing Power Parity (PPP).[6] In 2007, China became the third largest economy in GDP terms by overtaking Germany[7]. Now, we see China overtaking Japan in real GDP terms after the second quarter of 2010[8], hence becoming second only to the United States. Based on current trends, China looks set to overtake the US in PPP terms by 2017. Dr Gene Huang, ranked one of the world’s most accurate forecasters anticipates that China will take over US’s position as global economic powerhouse by 2020[9].

China’s Role in Asia

Given this context, I suggest the following strategic challenges for China in its role in Asia, economically and politically as well as demographically.

Firstly, China faces the challenge of demonstrating that its continued economic growth and position as Asia’s economic powerhouse will bring about positive economic effects for the region as a whole. It is not just developed nations which fear a hollowing out of their industries to cheaper alternatives in China. Many countries in Asia also fear that many of its companies cannot compete head on with vast amounts of cheap labor which China offers. The reality is of course much more complex. Many middle income developing countries in Asia, including Malaysia, have seen their share of exports to China rise in the intermediate goods category, especially in the electronics sector even as it has seen its share of textile exports to the rest of the world drop as part of this hollowing out effect. This is part and parcel of economic readjustment as these countries are forced to move up the ‘value chain’.

The challenge then for China is to assuage fears among the majority of these countries that there won’t be a giant ‘sucking’ sound, of jobs and investment migrating in large numbers to China or of cheap Chinese imports flooding domestic markets. One way of assuaging such fears is China’s commitment to play by the rules of international trade including monitoring cases of Chinese companies possibly ‘dumping’ their goods in various markets in Asia. China’s accession into the WTO in 2001 partly assuages these fears. Its behavior towards complying with these rules will continue to be monitored closely even after the end of the 12 year period whereby a ‘special Transitional Safeguard Mechanism’ was put in place to examine ‘cases where imports of Chinese origin cause of threaten to cause market disruption to domestic producers of other WTO members’.[10]

Secondly, China needs to strengthen its internal institutional mechanisms to ensure that investors in China, both at the governmental and corporate levels, from the middle income countries in Asia such as Malaysia and Thailand as well as the high-income countries such as Japan, Korea and Singapore, are afforded and given the same kinds of institutional safeguards and assurances as that which is available in the advanced industrial economies, especially protection of intellectual property and bills of guarantee for freedom from censorship in the internet.

Thirdly, China’s increasing economic muscle has already and will continue to encourage Chinese companies to expand its operations abroad, not only in terms of setting up factories, building roads and railways, establishing regional headquarters but also acquiring companies in various parts of Asia. The cover of a recent copy of the Economist (Nov 13th to 19th) asserts that Chinese companies will soon by ‘buying up the world’ in the form of Chinese takeovers. This reverse investment by China from the position as the recipient of the largest foreign investment in history should be a positive development but has strangely acquired political overtones that sometimes overshadow the strictly commercial nature of the investments.

China needs to assuage these fears that the primary motive for these investments is driven purely by commercial considerations. That is the first step. A further demonstration that the profit or commercial motive is perfectly consistent with the economic interests in the countries in which they are investing in. This means following the advice of the Economist, including ‘hiring local managers, investing in local research and placating local manager – for example by listing subsidiaries locally’.

One tangible example of how Chinese investment can be seen to benefit other countries in the region is by allowing Chinese portfolio funds to invest in the stockmarkets of these countries. Malaysia has been a beneficiary of this. China’s recent approval of Malaysia as a destination for Chinese portfolio funds through the China Qualified Domestic Investor Status is also expected generate larger inflows of Chinese investments into Malaysia[11] and Malaysia is one of 11 countries that have become approved investment destinations.[12]

The fourth challenge that impacts not just on China but beyond is the need to review its one-family, one-child policy. Whilst such a stern family planning policy may be necessary to prevent an uncontrolled population boom, in the long run this will result in a speeded up aging of society. Further this will also bring forth dysfunctional families where not just the parents but both paternal and maternal grandparents devote themselves to one child. Family planning policies should be geared towards replacement of their parents by their offsprings not the reverse. The effects of a speeded-up aging of society and their impact on economic growth and financial implications can be seen not just in Western Europe and Japan but also in Singapore. As China is a key driver of economic growth, a speeded up aging society would definitely slow down not just economic growth but its thirst human resources will also draw human talents away from countries that can least afford to lose them.

Asia’s Role in China

In the previous section, the onus was on China to demonstrate its ability to overcome some of the challenges associated with its growing economic, political as well as military clout. The end goal is for other countries in the region and its citizens to see that having a strong partnership with China is a desirable objective to have and that China can bring about more positive benefits to the region than negative.

But countries in Asia also have to recognize that they have their roles to play in actively engaging China so that the premise of this positive win-win relationship can be enhanced not only in their own countries but in China as well.

One obvious way in which this can be done is to highlight the benefits that trade and investment with Asia has benefitted not only Asia but also China as well. To quote Wen Jiabao: “China and ASEAN countries are connected by mountains and rivers. We have similar historical experiences and common development objectives. Our destinies have never been as closely interconnected as they are today”[13]

The share of ASEAN trade with China has been rising steadily, from 2.1% in 1993 to 11.3% in 2008. Exports from ASEAN to China have risen from 2% to 10% from 1993 to 2008, while imports from China into ASEAN have risen from 2% to 13% during the same period[14]. The ASEAN-China Free Trade Area (ACFTA) was fully implemented at the beginning of 2010, forming the world’s largest free trade area of developing countries[15]. As a result, in the first 3 quarters of 2010, ASEAN-China trade volume totalled 211.3 billion USD, up 44% from the previous year[16]. Currently, China is ASEAN’s largest trading partner, ASEAN being China’s fourth largest trading partner[17]

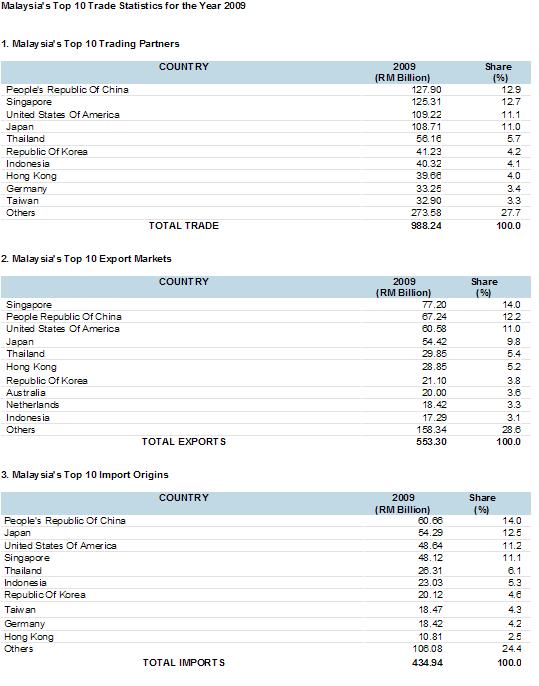

Even in Malaysia, China is Malaysia top trading partner in 2009 with 12.9% of trade volume compared to 11% in 2008. China surged from foruth in 2008 to No. 1 in 2009 nudging aside, Singapore, USA and Japan. With the balance of trade favouring Malaysia, definitely these trade ties are valuable for Malaysia.

FDI net inflow from China into ASEAN has been growing steadily from 608 million USD in 2005 to 2.1 billion USD in 2008[18] before the economic crisis occurred. Now that the economy has recovered somewhat, for the first half of 2010, ASEAN direct investment in China amounted USD3.1 billion, while China’s non-financial direct investment in ASEAN amounted USD1.2 billion[19]. Increasing trend of cooperation between ASEAN and China. Eg: In 2009, China announced a loan of USD15 billion to ASEAN countries to promote interconnectivity between nations and improved infrastructure and China-ASEAN Inter-bank Association programme initiated by China Development bank and other banks of ASEAN countries to better finance bilateral cooperation[20].

The increasing investment to and from China has also given rise to an increase in the number of visitors and workers to China from other parts of Asia and from China to other parts of Asia. Here is an area in which I strongly feel has been neglected and under leveraged in terms of its potential impact of Asia-China relations. There is nothing more powerful than when an individual has a positive experience in a country whether it is a Malaysian studying, travelling or working in China or a Chinese studying, travelling or working in Malaysia.

There is a need to strengthen people to people links. Because of our shared heritage and culture, which includes Sun Yat-Sen, the founder of modern China, having once stopped and stayed in Penang while trying to raise funds for the revolution, there are many Malaysians working and living in China and also a large number of Chinese students and workers studying and living in Malaysia. Many Malaysian professionals are regarded as highly valued employees in China because of their command of Mandarin and English as well as overseas education.

Malaysia and Penang should take try to leverage on this cultural and historical advantage. Further the attractions of Penang in health tourism with 2/3 of receipts in Malaysia, a vibrant cultural and entertainment lifestyle and a UNESCO World Heritage would offer a unique experience that is awaiting discovery for the Chinese traveler.

At the same time, Malaysia also needs to do much more in terms of protecting the welfare and needs of Chinese nationals in Malaysia, most notably the growing Chinese student population. China places an important emphasis on education, as can be seen from then-president Jiang Jemin’s call for higher enrolment into higher education in 1998[21]. A Mutual Recognition Agreement (MRA) on higher education degrees between Malaysia and China has been set up (to be signed)[22] Some Malaysian private universities like Limkokwing University of Creative Technology have opened up branches in China[23]. Malaysia is also inviting some of China’s top universities to set up their branches in Malaysia.[24] The Chinese students who are treated well will respond positively and will continue to have confidence in the Malaysian education system only if steps are taken by the Malaysian government as well as individual universities and university colleges to ensure that the education product is of a sufficiently high quality.

Conclusion: Prosper Thy Neighbour Policy

I have structurec my presentation to focus on the challenges which China faces in engaging with the rest of Asia as well as the challenges which Asian countries face in engaging with China. These challenges take place within the boundaries of China, sometimes in disputed and international territories, and often within the boundaries of the Asian countries themselves, which includes Malaysia. I trust and believe that it is in everyone’s interests to resolve these territorial disputes peacefully.

We, and by that I mean other Asian countries, have to stop looking at China as a threat. Neither should we look at China as ‘merely’ an opportunity where our companies can make money in or where our citizens can work in or where we can attract foreign investment or students or tourists from.

We should see in China as having common benefits and facing similar problems, especially managing rapid urbanization. By 2050 up to 75% of the world’s population would be living in cities. How we manage the problems associated with cities would determine the prosperity, peace and harmony of our people.

To have a truly meaningful relationship that benefits both sides, we need to think of how we can add value and meaning and possibly even joy to the average Chinese citizen which we can have access to, either in China or within our own borders. And if China can reciprocate in this prosper thy neighbour policy, then this will surely be the century for cities and of Asia.

——————————————————————————–

[1] http://www.economywatch.com/economic-statistics/country/Developing-Asia/

[2] http://www.chinability.com/GDP.htm

[3] http://money.cnn.com/2010/10/20/news/economy/china_gdp/index.htm

[4] http://www.chinadaily.com.cn/bizchina/2010-04/22/content_9760627.htm

[5] http://www.economywatch.com/economic-statistics/country/China/

[6] http://en.wikipedia.org/wiki/Economy_of_the_People%27s_Republic_of_China#2000.E2.80.93present

[7] http://en.wikipedia.org/wiki/Economy_of_the_People%27s_Republic_of_China#2000.E2.80.93present

[8] http://www.bloomberg.com/news/2010-08-16/china-economy-passes-japan-s-in-second-quarter-capping-three-decade-rise.html

[9] http://www.channelnewsasia.com/stories/afp_world_business/view/1083010/1/.html

[10] http://www.wto.org/english/news_e/pres01_e/pr243_e.htm

[11] http://www.btimes.com.my/Current_News/BTIMES/articles/rup020b-2/Article/

[12] http://www.chinadaily.com.cn/bizchina/2010-06/25/content_10019269.htm

[13] http://news.xinhuanet.com/english2010/china/2010-10/29/c_13582167.htm

[14] AEC-Chartbook-2009

[15] http://english.peopledaily.com.cn/90001/90778/90861/7183781.html

[16] http://news.xinhuanet.com/english2010/indepth/2010-07/26/c_13415967.htm

[17] http://english.peopledaily.com.cn/90001/90778/90861/7183781.html

[18] http://news.xinhuanet.com/english2010/indepth/2010-07/26/c_13415967.htm

[19] http://eng.caexpo.org/news/t20101023_90764.html

[20] http://news.xinhuanet.com/english2010/china/2010-10/29/c_13582167.htm

[21] http://www.foreignpolicy.com/articles/2010/01/04/123000000000000?page=0,0

[22] http://www.themalaysianinsider.com/malaysia/article/malaysia-china-to-sign-mra-on-higher-education-degree/

[23] http://www.themalaysianinsider.com/malaysia/article/malaysia-china-to-sign-mra-on-higher-education-degree/

[24] http://news.xinhuanet.com/english2010/china/2010-08/19/c_13452276.htm

[25] http://english.peopledaily.com.cn/90001/90782/90873/6696582.html

Speech By Penang Chief Minister Lim Guan Eng At The 6th Asia Economic Summit In China Development Institute In Shenzen, China On 10.12.2010 Released In Penang On Same Date.